CCAR News

Together for the Children: A Night of Hope and Healing at Children’s Advocacy Center of Collin County’s Gala

Together for the Children: A Night of Hope and Healing at Children’s Advocacy Center of Collin County’s Gala On a night filled with purpose, compassion, and community, the Collin County Area REALTORS® (CCAR) had the honor of serving as the honorary chair for the Children’s Advocacy Center of Collin County’s (CACCC) annual Gala—an unforgettable evening…

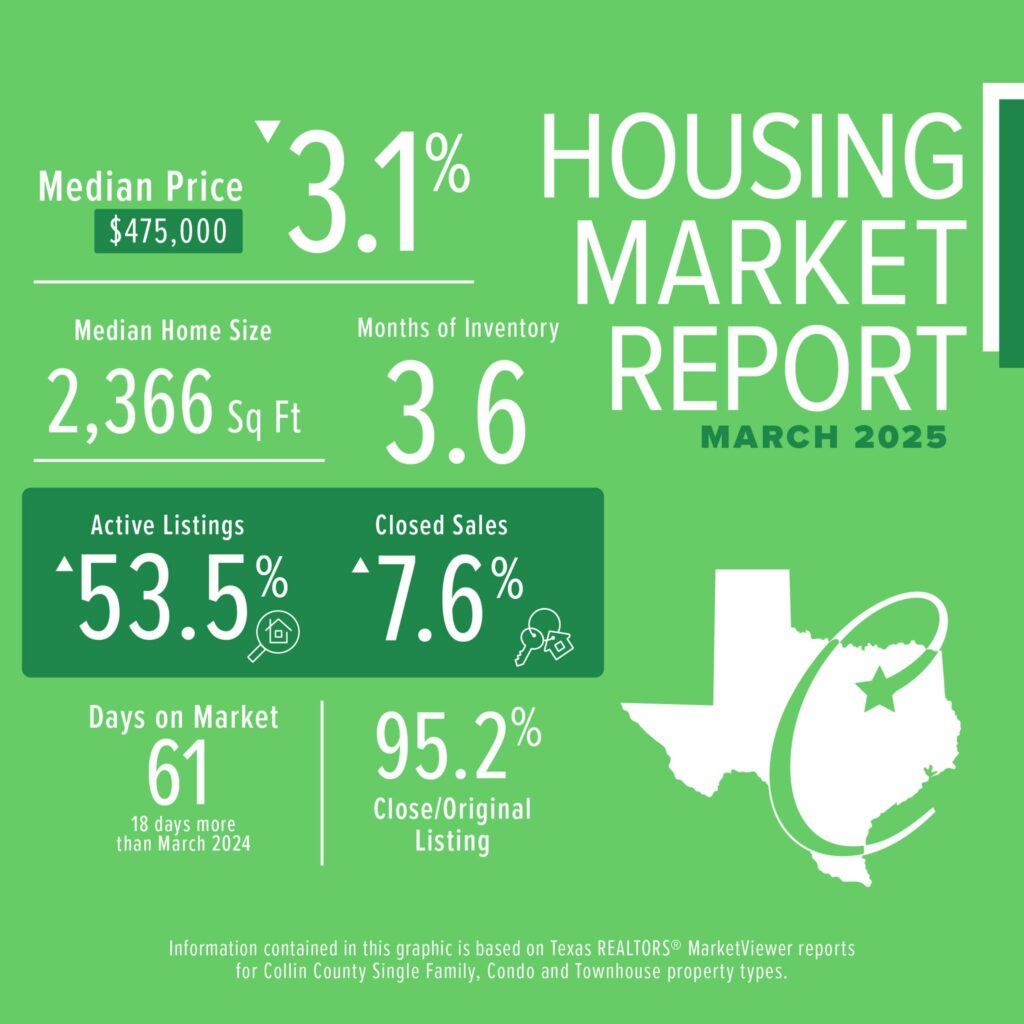

Read MoreMore Homes, More Choices: Collin County Housing Market Gains Inventory in March

More Homes, More Choices: Collin County Housing Market Gains Inventory in March CCAR reports a surge in new listings during March 2025 gave homebuyers significantly more options, signaling a shift toward a more balanced housing market. New listings in Collin County increased by 26.5% compared to March 2024. Combined with already growing inventory levels, this…

Read MoreWhat Texas Homeowners Need to Know About Property Taxes in 2025

What Texas Homeowners Need to Know About Property Taxes in 2025 It’s that time of year again—property appraisal notices are hitting mailboxes, and Texas homeowners are once again bracing for potential increases. But before filing a protest, it’s important to understand how property taxes are actually calculated in Texas. In our latest Welcome to the…

Read MoreCCAR & MetroTex Merger Informational Website

CCAR & MetroTex Merger Informational Website We appreciate your engagement as we continue the due diligence process following the March 27 vote by the CCAR and MetroTex Boards of Directors to approve a Plan of Merger. This step represents a tremendous opportunity to strengthen the real estate industry in North Texas. Both CCAR and MetroTex…

Read MoreCCAR and MetroTex Approve Plan of Merger

CCAR and MetroTex Approve Plan of Merger On March 27, 2025, the CCAR and MetroTex Board of Directors voted to approve a Plan of Merger. This vote allows both associations to participate in a due diligence period. By merging the two strongest associations in the region, we hope to take a significant step forward for…

Read MoreAdvocacy, Policy, and Innovation: Key Takeaways from the Texas REALTORS® Winter Meeting with Jason Petrie and Marvin Jolly

Advocacy, Policy, and Innovation: Key Takeaways from the Texas REALTORS® Winter Meeting with Jason Petrie and Marvin Jolly In the world of real estate, staying informed about policy changes, market trends, and new business strategies is essential for success. That’s why we’re excited to share our recent conversation with Jason Petrie, CCAR’s Government Affairs Director,…

Read MoreAnnouncing CCAR TRLP Class XVII

Announcing CCAR TRLP Class XVII Please join us in congratulating these Collin County Area REALTORS® and area association participants on their acceptance into the 2025 Texas REALTORS® Leadership Program (TRLP) Class XVII. They were nominated, accepted, and now begin their journey to becoming part of an elite group of real estate leaders. Click here to…

Read MoreUnderstanding How Rising Insurance Costs Impact Home Affordability in Collin County

Understanding How Rising Insurance Costs Impact Home Affordability in Collin County In real estate, affordability is a top priority for buyers. Recently, however, one factor has become increasingly important in determining a buyer’s ability to secure a loan: homeowners insurance premiums. In a recent video, Shane Hartje, Loan Officer at CMG Home Loans and a…

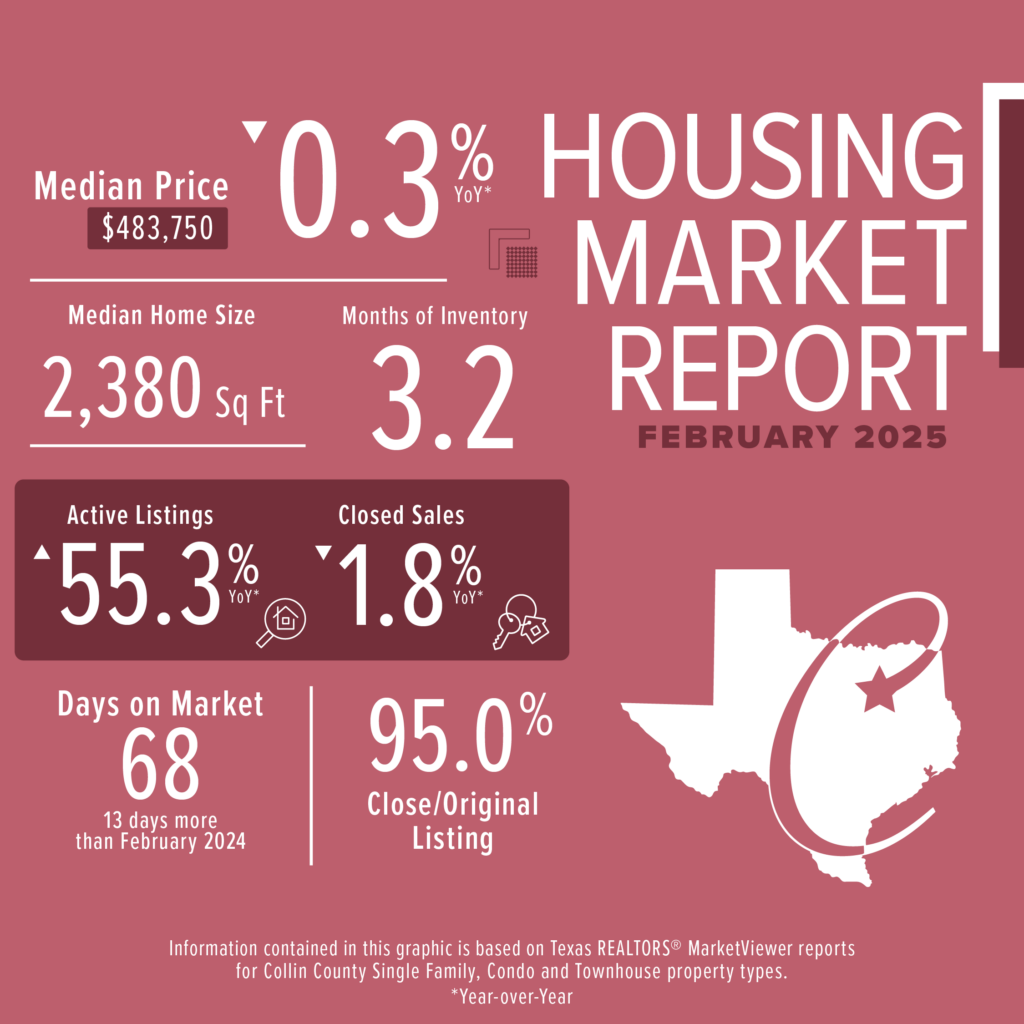

Read MoreCollin County Home Inventory Accelerates Sales Not Prices

Collin County Home Inventory Accelerates Sales Not Prices CCAR reports that Collin County homeowners listed their homes at an increasing rate, accelerating sales but not prices throughout the county. In February 2025, new listings in Collin County increased by 7.1% compared to February 2024. Combined with an already growing inventory, this gave buyers 55.3% more…

Read More1031 Exchanges: Navigating the Identification Rules and 45-Day and 180-Day Deadlines

1031 Exchanges: Navigating the Identification Rules and 45-Day and 180-Day Deadlines By: Whitney Nash, Qualified Intermediary & Owner, Above & Below 1031, LLC and CCAR Affiliate Committee Member Investing in real estate can be a powerful way to build wealth, and savvy investors often leverage strategies to maximize their returns while minimizing tax burdens.…

Read More