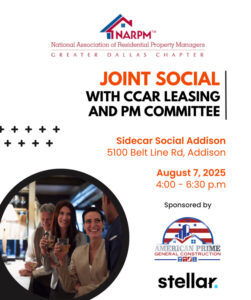

Property Managers: Let’s Connect!

National Association of Residential Property Managers Greater Dallas Chapter and CCAR Leasing and Property Management Joint Social Join us for a fun evening at our Joint Social! Connect with fellow industry professionals, enjoy great conversations, and expand your network in a relaxed setting. Sidecar Social Addison August 7, 2025 Free Registration Don’t miss this opportunity…

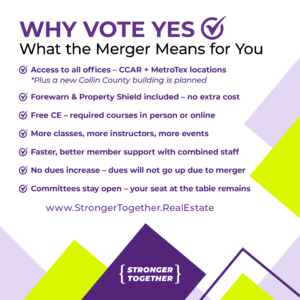

Proxy Voting is Underway: What You Need to Know

The proxy voting period is currently open for our voting members to cast a proxy vote on the proposed merger between Collin County Area REALTORS® and the MetroTex Association of REALTORS®. On July 15, a reminder was sent to members who had not yet cast their proxy vote. The reminder was sent from “announcement@associationvoting.com.” It’s…

Explore International Real Estate: You’re Invited to an AMPI Congreso 2025 Kickoff Event

Are you ready to take your real estate career across borders? MetroTex Association of REALTORS® has invited CCAR members to attend a special event designed to inform and inspire as they kick off the road to AMPI Congreso 2025-Mexico’s largest and most prestigious real estate conference and expo! 📅 Tuesday, July 15 🕑 2:00-4:00 PM…

Avoid the Pitfalls: Top 10 Mistakes in Property Management

Are you involved in property management or considering diving in? The CCAR Property Management and Leasing Committee invites you to an insightful presentation you don’t want to miss: “Top 10 Mistakes in Property Management.” Join us as two experienced attorneys specializing in property management break down the most common and costly mistakes professionals make in…

Unlocking Hidden Inventory: How Understanding the Senior Market Can Create More Listings

By: Kristy Osborn, CSA®, CDLP®, CMA™ Mortgage Equity Planner | Reverse Mortgage Division Lead Fairway Independent Mortgage Corp. and Member of CCAR’s Affiliate Committee In today’s low-inventory market, one group of homeowners is often overlooked: older adults. Many seniors want to stay in their homes-but there are just as many who do not. Often, they…

Merger Vote Recommended to Membership by CCAR & MetroTex Board of Directors

We are pleased to announce that after thorough due diligence, thoughtful discussion, and careful consideration, both the Collin County Area REALTORS® (CCAR) Board of Directors and MetroTex Association of REALTORS® (MetroTex) Board of Directors have voted to recommend a Plan of Merger between CCAR and MetroTex to the membership. Now, the proposed merger goes to…

Property Intelligence: AI’s Role in the Future of Real Estate

Article By Rachel Hinson “An AI tool won’t replace a human agent, but agents who embrace AI will have a distinct advantage over those who don’t.” – Luis Poggi, co-founder and CEO of Housewhisper Whether or not you use it, I think it’s safe to say that we’ve all heard of AI – Artificial…

The Advocacy Alliance You Need to Know About

If you’ve never heard of the American Property Owners Alliance (APOA), you’re not alone-but that’s exactly why you need to hear this episode. Marvin Jolly, Regional President and Past NAR RVP, joins the show to shed light on this nonprofit, nonpartisan organization that’s working behind the scenes to protect one of our most vital rights:…

What REALTORS® Should Know About Working with a Mortgage Lender in 2025

Written By: Chase Crenshaw, Mortgage Advisor & Loan Officer at Barrett Financial, NMLS #2100530, and CCAR Affiliate Committee Member Whether you’re new to the industry or a seasoned pro, this blog will shed some light on what’s happening right now in the mortgage world and how we can work together to make your deals go…

Does It Really Matter Who My Inspector Is? (Spoiler: YES. Yes, it does.)

By: J.J. Petersen, TREC #9278, Forerunner Inspections and CCAR Affiliate Committee Member What if I told you that hiring the right home inspector could save you a cool $14,000 on your next home purchase? That’s not Monopoly money-that’s the national average of savings negotiated from a quality pre-purchase inspection. Translation: the inspector you choose isn’t just a box to check-it’s…