Avoid the Pitfalls: Top 10 Mistakes in Property Management

Are you involved in property management or considering diving in? The CCAR Property Management and Leasing Committee invites you to an insightful presentation you don’t want to miss: “Top 10 Mistakes in Property Management.” Join us as two experienced attorneys specializing in property management break down the most common and costly mistakes professionals make in…

Unlocking Hidden Inventory: How Understanding the Senior Market Can Create More Listings

By: Kristy Osborn, CSA®, CDLP®, CMA™ Mortgage Equity Planner | Reverse Mortgage Division Lead Fairway Independent Mortgage Corp. and Member of CCAR’s Affiliate Committee In today’s low-inventory market, one group of homeowners is often overlooked: older adults. Many seniors want to stay in their homes-but there are just as many who do not. Often, they…

Merger Vote Recommended to Membership by CCAR & MetroTex Board of Directors

We are pleased to announce that after thorough due diligence, thoughtful discussion, and careful consideration, both the Collin County Area REALTORS® (CCAR) Board of Directors and MetroTex Association of REALTORS® (MetroTex) Board of Directors have voted to recommend a Plan of Merger between CCAR and MetroTex to the membership. Now, the proposed merger goes to…

Property Intelligence: AI’s Role in the Future of Real Estate

Article By Rachel Hinson “An AI tool won’t replace a human agent, but agents who embrace AI will have a distinct advantage over those who don’t.” – Luis Poggi, co-founder and CEO of Housewhisper Whether or not you use it, I think it’s safe to say that we’ve all heard of AI – Artificial…

The Advocacy Alliance You Need to Know About

If you’ve never heard of the American Property Owners Alliance (APOA), you’re not alone-but that’s exactly why you need to hear this episode. Marvin Jolly, Regional President and Past NAR RVP, joins the show to shed light on this nonprofit, nonpartisan organization that’s working behind the scenes to protect one of our most vital rights:…

What REALTORS® Should Know About Working with a Mortgage Lender in 2025

Written By: Chase Crenshaw, Mortgage Advisor & Loan Officer at Barrett Financial, NMLS #2100530, and CCAR Affiliate Committee Member Whether you’re new to the industry or a seasoned pro, this blog will shed some light on what’s happening right now in the mortgage world and how we can work together to make your deals go…

Does It Really Matter Who My Inspector Is? (Spoiler: YES. Yes, it does.)

By: J.J. Petersen, TREC #9278, Forerunner Inspections and CCAR Affiliate Committee Member What if I told you that hiring the right home inspector could save you a cool $14,000 on your next home purchase? That’s not Monopoly money-that’s the national average of savings negotiated from a quality pre-purchase inspection. Translation: the inspector you choose isn’t just a box to check-it’s…

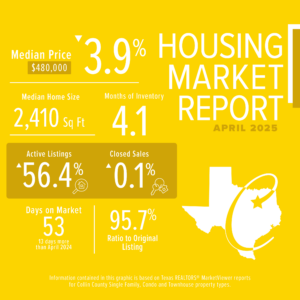

Spring Surge in Listings Shifts Market Power to Homebuyers in Collin County

Collin County Area Realtors (CCAR) reports that increased new listings provided homebuyers significantly more choices and negotiating power, resulting in increased activity and lower prices in April. New listings in Collin County increased by 20.5% compared to April 2024 (2,945 vs. 2,445). This, combined with a softening in the median sales price, down 3.9% to…

Beyond the Stigma: Prioritizing Mental Health in a Demanding Industry

May is Mental Health Awareness Month, and at Collin County Area REALTORS®, we’re having the conversations that matter most. In our latest Welcome to the Top podcast episode, CCAR President Jennifer Parker and COO Joanna Fernandez speak with CCAR team member Becky Pfaff, who brings a unique perspective to the conversation. Before joining CCAR’s Professional…

The Platform Winning Over Real Estate: Meet Tether RE

In our latest Welcome to the Top podcast, we sit down with Vanessa Martin, Co-Founder of Tether RE, to explore how Tether RE is solving some of the industry’s biggest challenges. Backed by major wins at the 2024 NAR iOi Summit and the T3 Technology Summit, Tether RE is more than just a new tool,…