Originally Published in the August 2019 Edition of North DFW Real Producers Magazine

Everyone dreads taxes, but for real estate professionals it is especially hard. Seasoned professionals are well aware by now that the best way to ease the blow is to be prepared.

Nonetheless, many real estate professionals were surprised to find that their typical approach failed them in 2018 thanks to the Tax Cuts and Jobs Act.

The Tax Cuts and Jobs Act (TCJA) was enacted in 2018, a tax reform bill that began affecting your tax return last year and will continue on all subsequent returns. The TCJA altered income tax brackets and the associated marginal tax rates, increased the standardized deduction, repealed the personal exemption, limited the amount of state and local taxes an individual can deduct, and more.

In an effort to ensure the highest level of preparedness, Jennifer Grammer, CPA at Lane Gorman Trubitt, LLC, spoke with us to discuss changes that are particularly important for real estate agents and brokers.

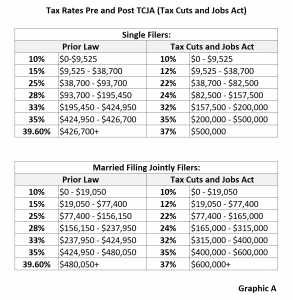

Question: What are the new tax brackets and what do they mean?

Grammer: The new income tax brackets and associated marginal tax rates are displayed in Graphic A. You can see the changes from previous years. Single Filers with a taxable income below $152,000 will enjoy a significantly lower tax rate, as well as filers who are Married Filing Jointly and have a taxable income less than $315,000.

There is also a significant reduction in the tax amount for those whose taxable income is in the top tier.

Question: Does TCJA change who benefits from itemizing or using the standard deduction?

Grammer: A larger portion of Americans found themselves using the standard deduction in 2018 rather than itemizing. Three aspects of TCJA that contributed to this are:

- The repeal of the personal exemption for each taxpayer of $4,150.

- The standard deduction increased to $12,000 for single filers and $24,000 for those married filing jointly.

- The TCJA implemented a $10,000 cap for state and local taxes for both single and married filing jointly filers. This means that no matter how much you pay in state and local taxes, you can only deduct up to $10,000 a year on Schedule A, Itemized Deductions.

These changes make the standard deduction beneficial for more homeowners, decreasing the allure of homeownership for many.

Question: Are there other changes a real estate agent or broker needs to know?

Grammer: Absolutely. Let me highlight three important aspects of TCJA that effect real estate professionals:

- Beginning last year, entertainment expenses are no longer deductible under the new tax law for businesses or independent contractors.

- TCJA repealed section 1031 Like-Kind Exchanges for personal property, but retained 1031 Like-Kind Exchanges for real property exchanges. This is a huge win for the real estate community, allowing for the deferral of gains from the sale of property used in a 1031 Like-Kind Exchange.

- TCJA reduced the corporate tax rate to a flat 21% tax rate for 2018 and going forward. Congress believed that pass-through entities/self-employed individuals should receive a tax break as well. As a result, the deduction for Qualified Business Income (QBI) was created.

Single business owners who earn $157,000-$207,500 qualify for QBI, with the full 20% for those earning $157,000 and phasing out up to $207,500. For business owners married filing jointly, the same benefit is received with income beginning at $315,000 and phasing out up to $415,000.

For income above these thresholds, there are more strenuous hurdles to jump through to receive the 20% QBI Deduction (ex: non-personal service business vs. Personal service business). It is important to consult your tax advisor to see which exceptions apply to you.

In summary, thanks to the QBI, if you are an independent contractor who reports your income on Schedule C, or a pass-through business owner, then you can deduct 20% of the QBI, subject to the income limits above.

For example, let us look at Miss Smith’s situation. Miss Smith is a single taxpayer and receives $112,000 in commissions in 2018. She also had $10,000 of business expenses in 2018. Miss Smith has no other income to report.

After the standard deduction ($12,000) and business expenses ($10,000), her taxable income is $90,000.

Miss Smith’s QBI is $102,000 ($112,000 gross commissions less $10,000 business expenses). The lesser of the two (taxable income vs. QBI) is what is used to calculate Miss Smith’s deduction.

- 20% of QBI = 20,000

- 20% of taxable income = 18,000

For Miss Smith, the taxable income is less, resulting in an $18,000 QBI deduction.

With Grammer’s help, you are more prepared for your 2019 taxes. However, preparedness should not replace the advice of a tax professional; always seek professional advice when making tax decisions.