Market Trends

Property Intelligence: AI’s Role in the Future of Real Estate

Property Intelligence: AI’s Role in the Future of Real Estate Article By Rachel Hinson “An AI tool won’t replace a human agent, but agents who embrace AI will have a distinct advantage over those who don’t.” – Luis Poggi, co-founder and CEO of Housewhisper Whether or not you use it, I think it’s safe…

Read MoreWhat REALTORS® Should Know About Working with a Mortgage Lender in 2025

What REALTORS® Should Know About Working with a Mortgage Lender in 2025 Written By: Chase Crenshaw, Mortgage Advisor & Loan Officer at Barrett Financial, NMLS #2100530, and CCAR Affiliate Committee Member Whether you’re new to the industry or a seasoned pro, this blog will shed some light on what’s happening right now in the mortgage…

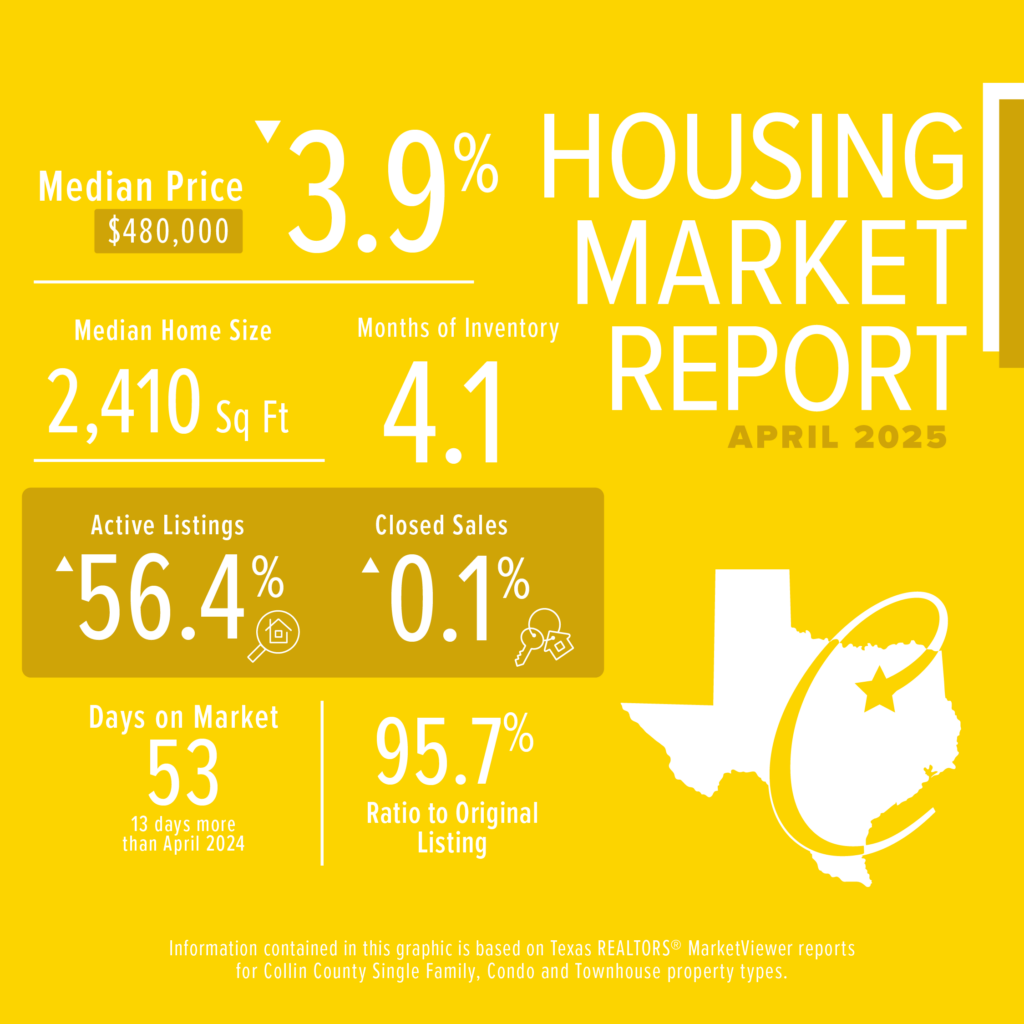

Read MoreSpring Surge in Listings Shifts Market Power to Homebuyers in Collin County

Spring Surge in Listings Shifts Market Power to Homebuyers in Collin County Collin County Area Realtors (CCAR) reports that increased new listings provided homebuyers significantly more choices and negotiating power, resulting in increased activity and lower prices in April. New listings in Collin County increased by 20.5% compared to April 2024 (2,945 vs. 2,445). This,…

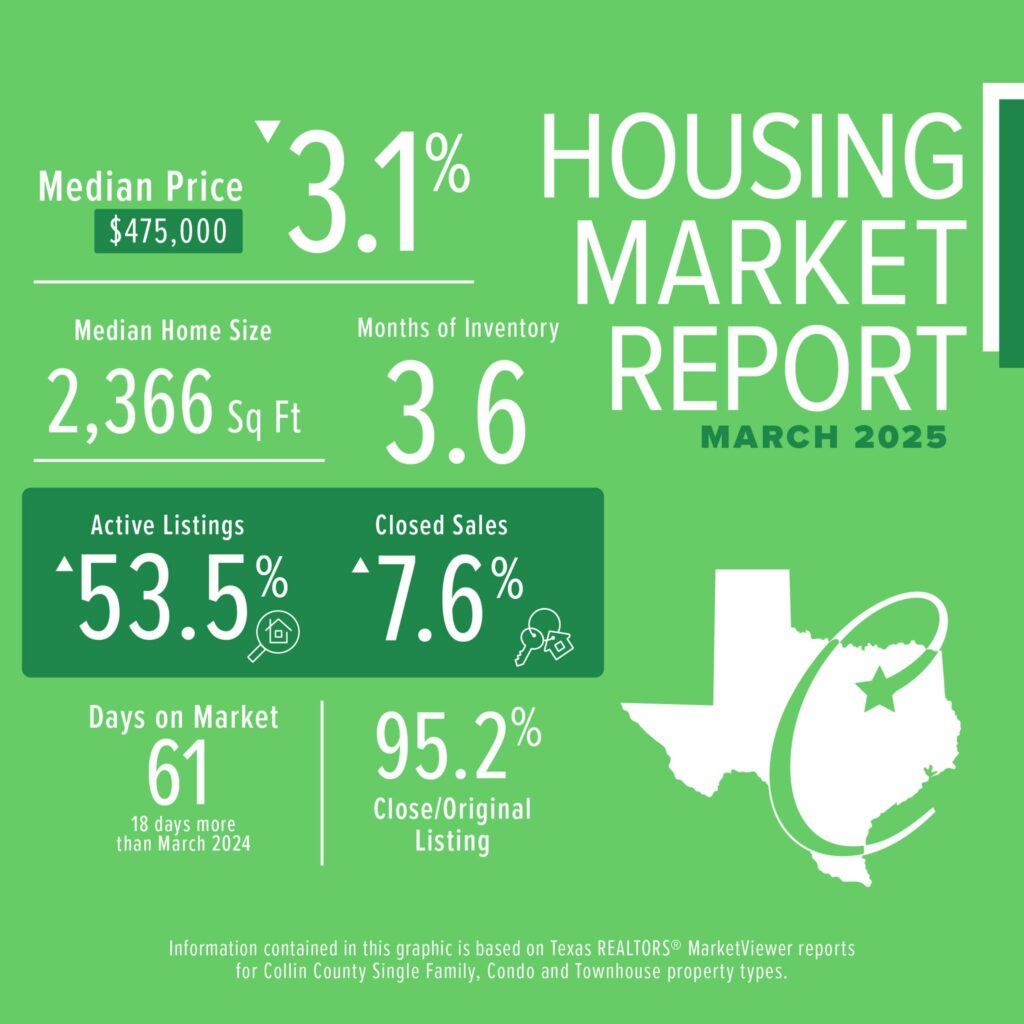

Read MoreMore Homes, More Choices: Collin County Housing Market Gains Inventory in March

More Homes, More Choices: Collin County Housing Market Gains Inventory in March CCAR reports a surge in new listings during March 2025 gave homebuyers significantly more options, signaling a shift toward a more balanced housing market. New listings in Collin County increased by 26.5% compared to March 2024. Combined with already growing inventory levels, this…

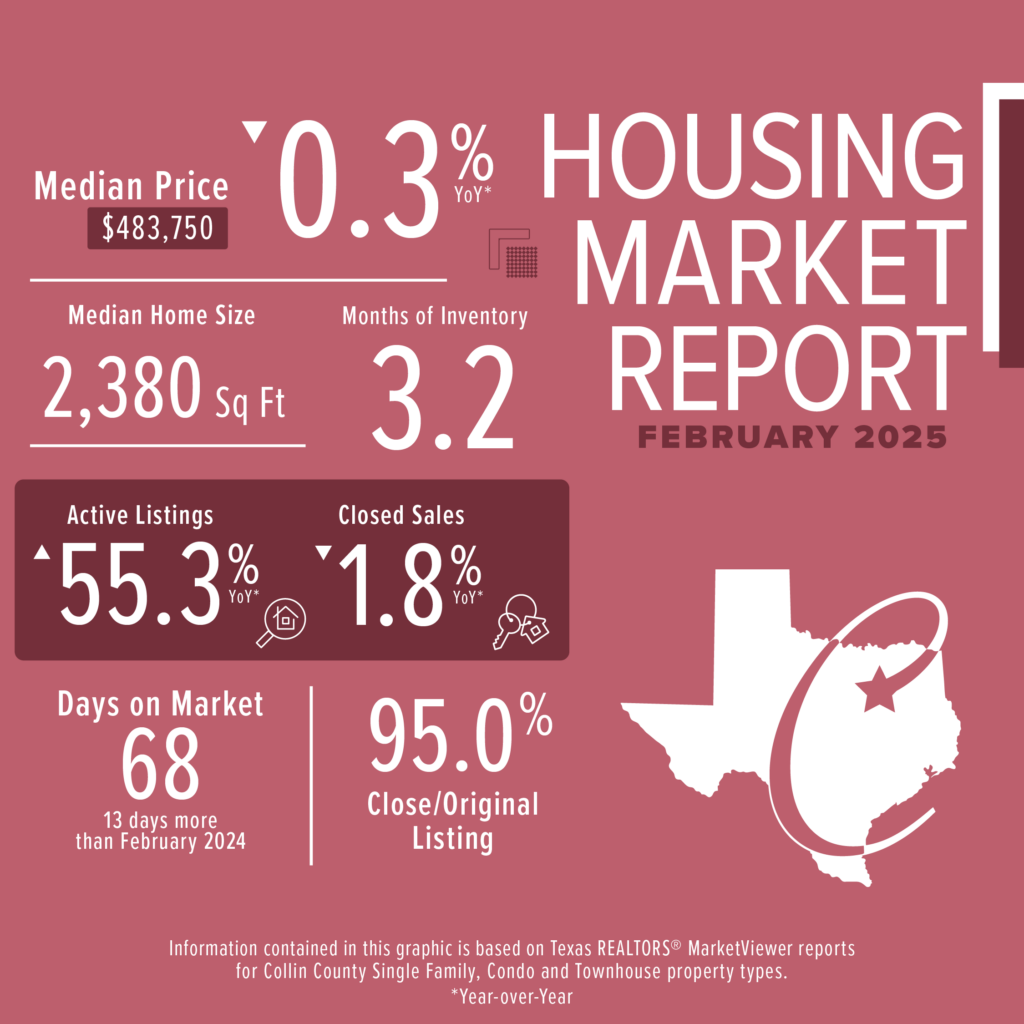

Read MoreCollin County Home Inventory Accelerates Sales Not Prices

Collin County Home Inventory Accelerates Sales Not Prices CCAR reports that Collin County homeowners listed their homes at an increasing rate, accelerating sales but not prices throughout the county. In February 2025, new listings in Collin County increased by 7.1% compared to February 2024. Combined with an already growing inventory, this gave buyers 55.3% more…

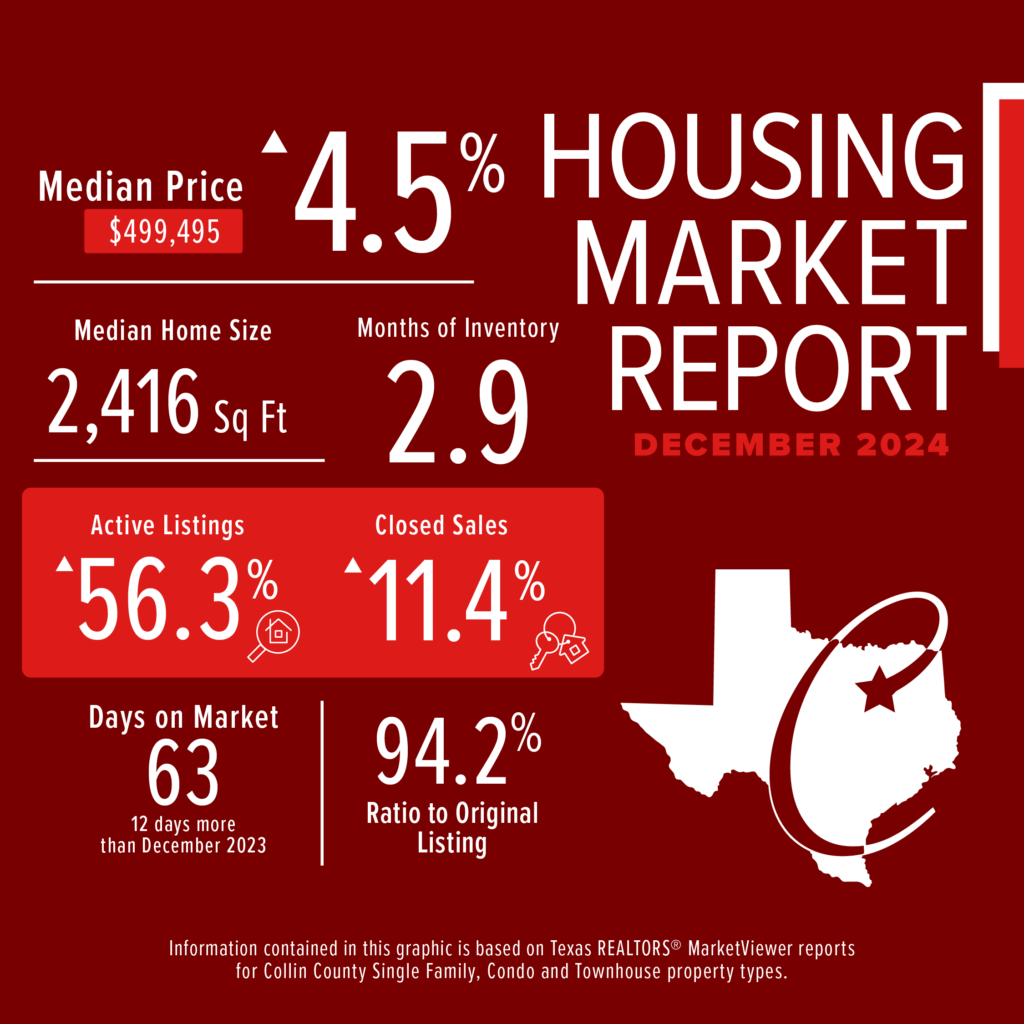

Read MoreDecember 2024 Housing Market

December 2024 Housing Market Collin County’s December market data is in! Take a look below to see how the county performed. Want more information? Collin County Area REALTORS® have access to in-depth market data as one of their member benefits. Learn More Categories CCAR Events CCAR News Government Affairs Lone Star Homes Market Trends North…

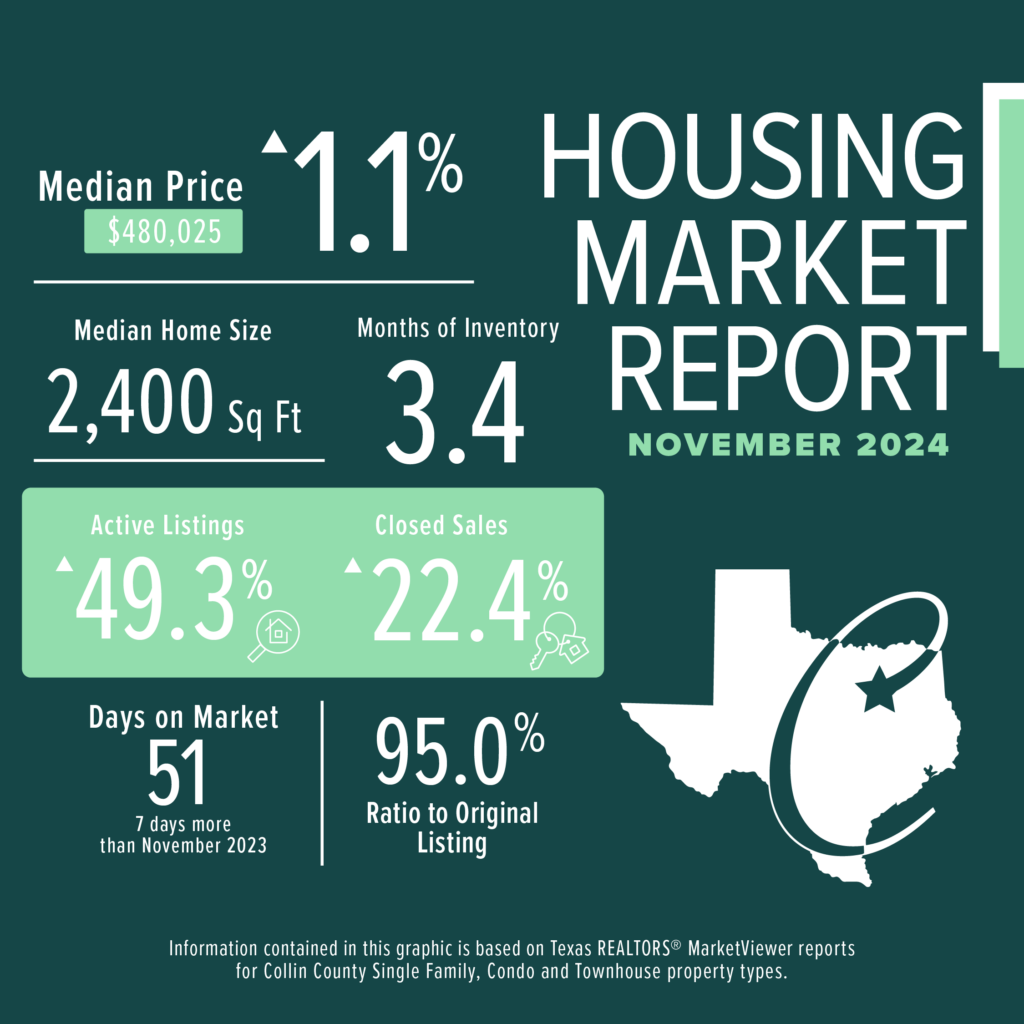

Read MoreCollin County November 2024 Housing Market Stats

Collin County November 2024 Housing Market Stats Here is a quick look at how the Collin County housing market performed in November 2024. Members can dig deeper into the data source with Texas REALTORS® MarketViewer. Categories CCAR Events CCAR News Government Affairs Lone Star Homes Market Trends North DFW Real Producers Magazine Professional Development Spotlight…

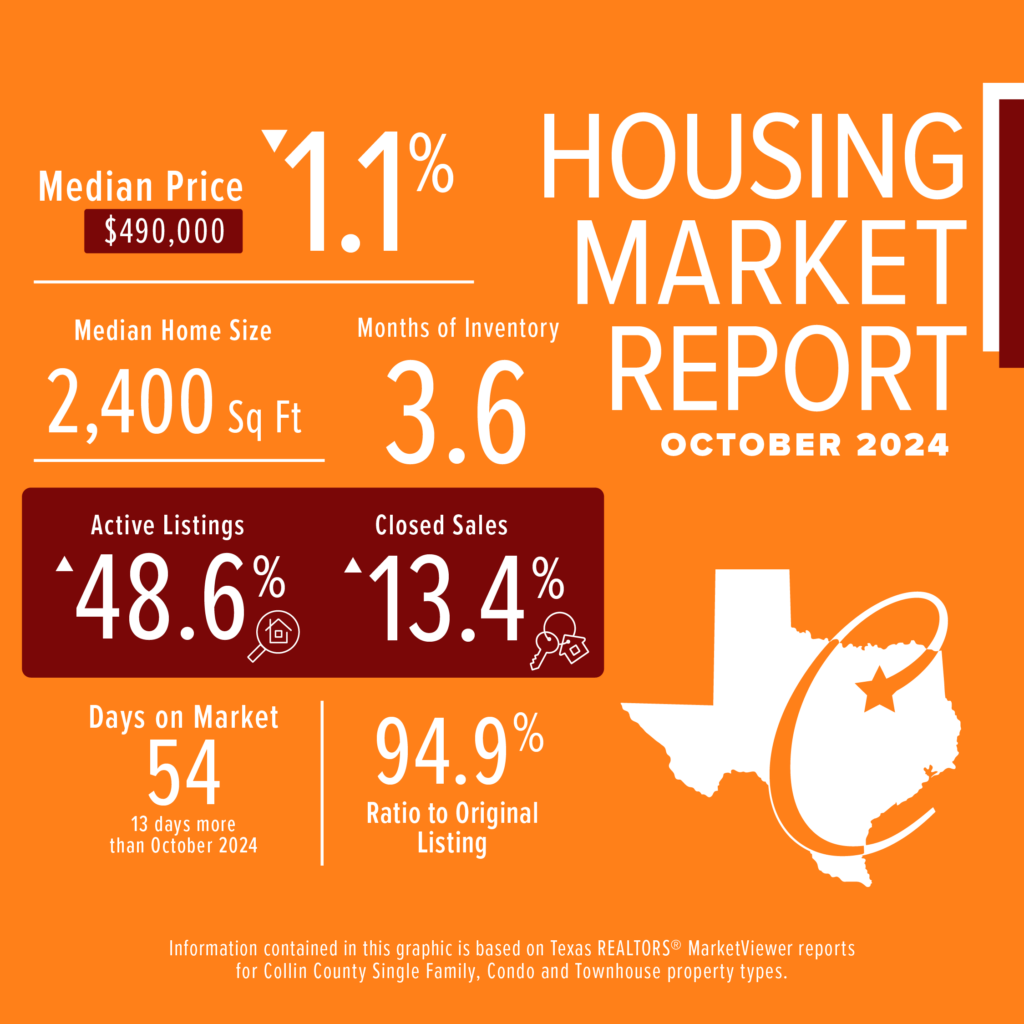

Read MoreTreats Not Tricks for Collin County Homebuyers

Treats Not Tricks for Collin County Homebuyers Collin County Area Realtors (CCAR) reports October homebuyers and sellers were rewarded with treats not tricks across Collin County as the market performed much the same as the month prior. In October, Collin County homes remained on the market for an average of 54 days, the same amout…

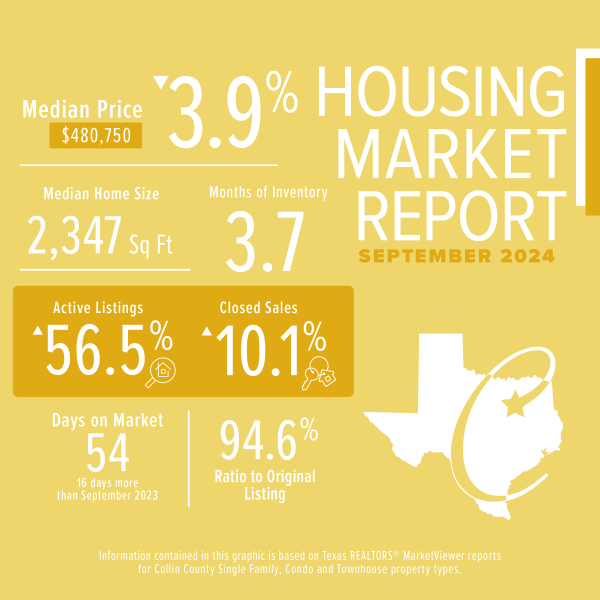

Read MoreCollin County Inches Towards a Balance Market

Collin County Inches Towards a Balance Market Collin County Area REALTORS® (CCAR) reports that the area may soon experience a balanced market as new listings increase across the county and homes take longer to go under contract. In September, Collin County homes remained on the market for an average of 54 days, 42.1% longer than…

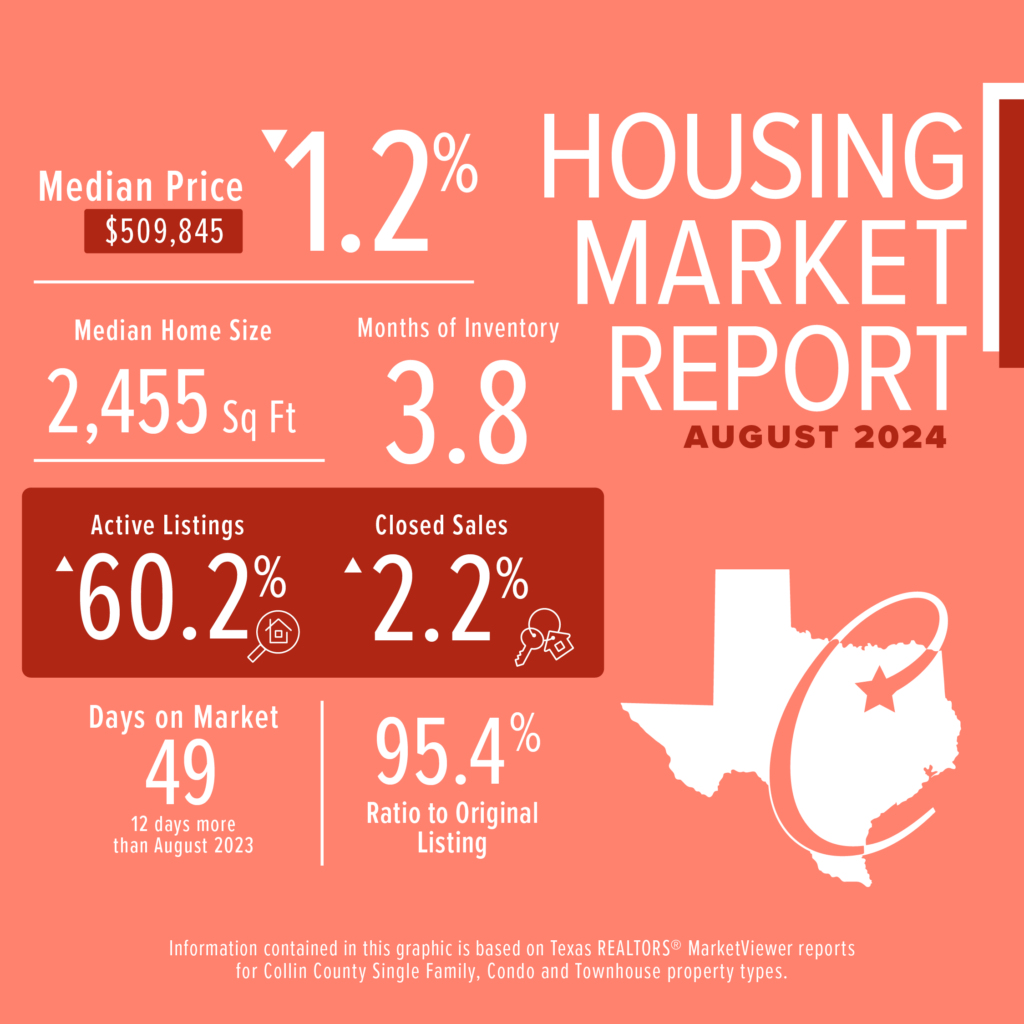

Read MoreSellers on Standby Throughout Collin County

Collin County Area Realtors (CCAR) reports that many home sellers were on standby throughout the county as they waited longer and accepted less when selling their home compared to one year ago. In August, Collin County homes remained on the market for an average of 49 days before going under contract for 95.4% of the…

Read More